Five tax-saving tips that every Locum should know

By Dr Surina Chibber

Are you dreading another huge tax bill this month? Are you being as tax efficient as possible? Here are 5 ways that could help to reduce your tax bill

It's remarkable that four out of five UK adults will waste an unnecessary £7.6bn in tax overpayment this year.

With the increasing cost of medical indemnity and professional subscriptions many doctors are feeling the strain on their finances. We all work hard to earn our keep so it makes sense to use sensible financial planning to legitimately reduce tax bills. Here are some tips to save money and help to keep your tax bills to a minimum.

1. Claim all tax-deductible expenses

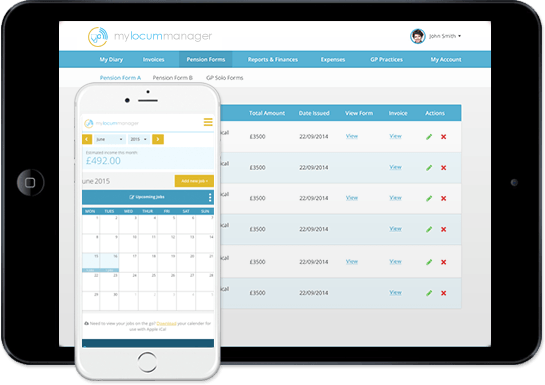

As a self employed locum you are allowed to deduct legitimate business expenses before paying tax. With MyLocumManager this is now even easier. Although we often expense for the larger things such as medical indemnity, we often forget to expense for everyday business costs that we pay as part of our locum work. These include train fares, parking tickets, parking permits, stamps, stationary and medical equipment. Although these may seem like small things when added together they can total to a few thousand pounds.

Over the last tax year I recorded every expense using the MyLocumManager site. It was easy using the web-app on my phone to add expenses as they occurred rather than trying to retrospectively go through my bank statements and receipts. Using this method I have managed to record over £1000 of expenses. I logged everything from stamp and stationary for pension forms to my car MOT and service costs. Try it for yourselves and see how much you could save.

2. Get an ISA

In a standard savings account you pay tax on any interest you earn on those savings. As interest rates are currently so low, this is the last thing you need. So to avoid this make sure you invest in an ISA. This is a tax-free way of saving and you can invest up to £15,240. You also get to choose how you split this between stocks and shares and cash ISA’s. Here is great site to find out more. http://www.moneysavingexpert.com/savings/ISA-guide-savings-without-tax

3. Think as a family, Not an individual

If your partner pays a lower tax rate it is possible to reduce the total amount of tax you pay as a couple if you arrange your finances correctly. You can also open a junior ISA for your children so you can save or invest for your child. MyLocumManager has an easy finance tracker which helps you track your earnings month by month so you can budget for your saving, investments and daily living expenditures.

4. Self Employed Car Costs

As a locum you can claim the running costs of a car, but not the cost of buying one. If you use the same car privately you can claim a proportion of the total costs.

MyLocumManager automatically records all your mileage so your accountant can offset these costs against your income. You can also add additional mileage from home visits in your expenses section so you ensure that you are claiming all your car costs effectively.

Don’t forget you can add any car repair or servicing costs onto the MyLocumManager expenses tool using the web-app.

5. Make your pension work for you

Contributions to your pension fund are fully allowable for income tax and the assets in the fund can grow free from tax. Many locums often miss out on claiming all their pensionable income. Manually sending out your form A & B, doing the pension calculations and chasing practices for signed forms can often lead to payments deadlines being missed. With MyLocumManager your pension forms are automated and electronic, so can be generated and sent at the touch of a button. Because MyLocumManager is available on your phone you can track and send your pension forms on the go.

As a Locum GP it is important to keep a meticulous financial record and to use a good accountant. That's why we have teamed up with Mansoor Shafique and his team at Medic Accountants who are experienced medical accountants. They are offering all MyLocumManager customers an exclusive discount on their accounting fees and free specialist advice to help you save money.